The best part about the numbers is they tell it like it is — no individuality, no over inflation, no emotions… strictly the FACTS.

The fact is, the Hamptons 1st Quarter Home Sales Report reflects, frankly, a mixed bag.

In general, the report on the first three months home sales activity shows 10 of the 12 of the individual markets monitored by TOWN & COUNTRY had fewer transfers. East Hampton Village saw a drop of 44% and Bridgehampton (which includes Water Mill and Sagaponack) saw a 39% drop in Number of Home Sales— these are significant statistical changes.

Bridgehampton (which includes Water Mill and Sagaponack) had quite a pull back, with not only 39% less Home Sales, but 42% less Total Homes Sales Volume, and the final criteria we monitor, Median Home Sales Price, slightly lower by 3%. The $10-$19.99M price range was off by 67% in Bridgehampton (which includes Water Mill and Sagaponack).

n a positive note, Shelter Island spread its wings nicely with a whopping 70% jump in Number of Home Sales, 59% increase in Total Homes Sales Volume and nearly 10% rise in Median Home Sales Price. A shining quarter for the Island.

East Hampton Village statistics deserve close examination. Not only the slide of 44% fewer Number of Home Sales but RED in every price range … except the over $20M, where the 2 sales for the first 3 months were: 101 Lily Pond Lane at $63.8M and 93 Lily Pond Lane for $22M. SAB Capital owner Scott Bommers sold his 3 Lily Pond Lane holdings for a total of $110M — an off-market deal.

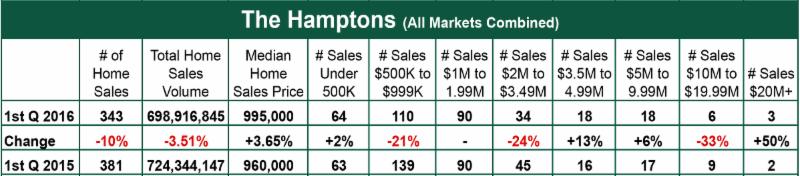

Looking at All Hamptons Markets Combined and you see that from a broadstroke the East End Real Estate market held strong, while the stock market was in a bit of a free fall followed by a bounce. The Median Home Sales Price increased a respectable 3.65% to $995,000 while the Numer of Home Sales declined by 10%.

Thank goodness it’s Spring!

To view the full report click here.